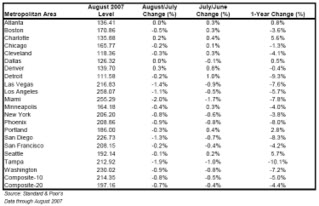

Although the home prices here in Seattle have recently dropped a bit, when comparing prices in August 2006 to August 2007 prices actually increased 5.7% according to the S&P/Case-Shiller Home Price Indices report released today. There were 4 other cities among the 20 metropolitan regions across the United States that saw increases: Atlanta, Dallas, Charlotte & Portland.

Although the home prices here in Seattle have recently dropped a bit, when comparing prices in August 2006 to August 2007 prices actually increased 5.7% according to the S&P/Case-Shiller Home Price Indices report released today. There were 4 other cities among the 20 metropolitan regions across the United States that saw increases: Atlanta, Dallas, Charlotte & Portland.

On a pessimistic note, home price declines across the US mark the 8th consecutive month of negative annual returns and the 21st consecutive month of decelerating returns.

Click here to read the S&P/Case-Shiller Home Price Indices report 10/30/2007

The S&P/Case-Shiller Home Price Indices measures the residential housing market, tracking changes in the value of the residential real estate market in 20 metropolitan region across the United States. These indices use the repeat sales pricing technique to measure housing markets. First developed by Karl Case and Robert Shiller, this methodology collects data on single-family home re-sales, capturing re-sold sale prices to form sale pairs. This index family consists of 20 regional indices and two composite indices as aggregates of the regions.

In addition, the S&P/Case-Shiller U.S. National Home Price Index is a broader composite of single-family home price indices for the nine U.S. Census divisions and is calculated quarterly.